45+ how much should a mortgage be of your income

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs.

. Its A Match Made In Heaven. Web Then multiply that number by 028 to find the maximum you should be spending on your mortgage payment. Get Your Estimate Today.

This means your monthly payments should be no more than 31 of your. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Looking For A Mortgage.

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Web With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Another calculation you can use to find how. Ad Get The Service You Deserve With The Mortgage Lender You Trust. Get Your Estimate Today.

Realize Your Dream of Home Ownership this Year. Find A Lender That Offers Great Service. Ad How Affordable is a Mortgage.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Lets say your total.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Refinance Your Home Through An FHA Streamline Refi With Mr. And they see a 28 DTI as an excellent one.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The 3545 Rule The 3545. Ideally that means your monthly.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Estimate your monthly mortgage payment. Its A Match Made In Heaven.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your. Ad We Are a Locally-Owned Mortgage Broker.

25 of Net Income. Were Americas 1 Online Lender. Were Americas 1 Online Lender.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Compare More Than Just Rates. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

Looking For A Mortgage. Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators. Ad FHA Streamline Loans Are A Unique Refi Option For Borrowers Who Already Have An FHA Loan.

Find Out How Much You Can Afford. With a general budget you want to. Web 25 Post-Tax Model.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Ad See how much house you can afford.

Cmp 8 02 By Key Media Issuu

How Much Mortgage Can I Qualify For In Nyc Hauseit

How Much Of My Income Should Go Towards A Mortgage Payment

Maine Realtor Winter 2020

45 Ways To Live A Great Life Starting In 2023 How To Live A Great Life

What Percentage Of Your Income To Spend On A Mortgage

Should I Refinance To A 15 Year Mortgage Hubpages

Fnbb Are You A First Time Home Buyer With A Steady Facebook

Redfin Sun Belt Buyers Need 40 More Income Than They Did A Year Ago To Afford A Home The Business Journals

Income Fund Portfolio Managers Discuss Rising Rates And The Impact On Bond Investors Pimco

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can You Afford Calculator Cnet Cnet

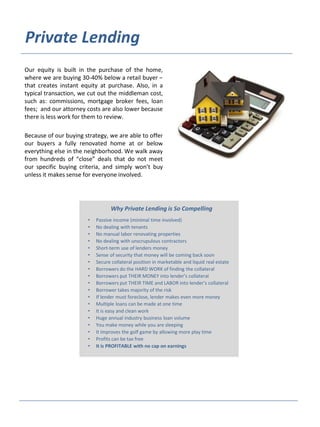

Private Money Lender Credibility Packet

Private Money Lender Credibility Packet

Real Estate Carrying Costs Make The Most Of Your Investment

Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck Urban Institute